Easily obtain an EORI code

(Registration and Identification Number of Economic Operators)

Complete services for obtaining the EORI code: consulting, preparation of files, drafting the application, submission of documents to Customs

Useful info

NO HIDDEN TAXES

We do NOT charge an additional fee for unlocking your application.

We do NOT charge an emergency fee.

We have the experience of over 8000 customers.

Apply at any time, from any place.

We process your request on the spot.

Pay online without stress and without going to the bank.

You receive the EORI code directly in your inbox.

We will notify you by email and phone when the EORI code has been released.

Payment can be made online with mobilPay or by bank transfer.

What is an EORI code

An EORI code is a unique identification number in the customs territory of the European Union, assigned by the customs authority to an economic operator or an individual for registration for customs purposes. Once assigned, the unique EORI number must be used in all customs transactions and activities in the territory of the Union whenever an identifier is required. Each individual or organisation may have a single EORI number for use, as required, in all communications with any customs authority within the European Union.

Who needs an EORI code

The entities required to apply for an EORI code are organisations engaged in import, export, transit, warehousing, representation, as well as operations prior to the arrival / departure of goods entering / leaving the territory of the EU and individuals entering / leaving goods / from the European Union.

How to obtain an EORI code

Procedure for obtaining the EORI code:

1. You send us the necessary documents via the form or by email to generare@cod-eori.ro

2. We write the application for obtaining the EORI code.

3. We submit the files for you to Customs.

4. We will send you the EORI code by e-mail within ~2-48 hours of submitting your application.

5. You can start import-export business outside the EU.

The purpose of an EORI code

EU customs authorities assign a unique number (EORI code) to individuals or organisations in order to have easy and secure access to their registration and identification data, as well as to exchange data between customs authorities.

Required documents

Entities established in Romania

Copies of the following documents are required:

Organisations:

- the registration certificate from the National Office of the Trade Register;

- the certificate of registration for VAT purposes, if the company is a VAT payer;

- the constitutive act;

Individuals:

- ID card;

Entities established outside the EU

Copies of the following documents are required:

Organisations:

- the certificate of registration issued by the authorities of the third country;

- the certificate of registration for VAT purposes if the company is a VAT payer;

- documents showing the address of the registered office or of the current fiscal residence;

Individuals:

- passport;

Over 8000 EORI codes obtained.

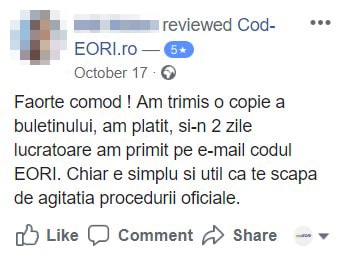

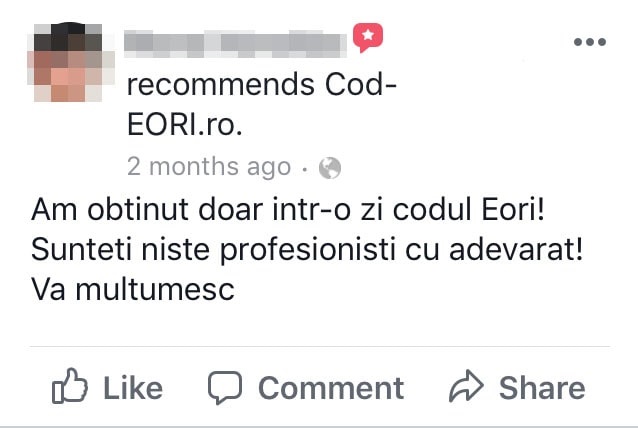

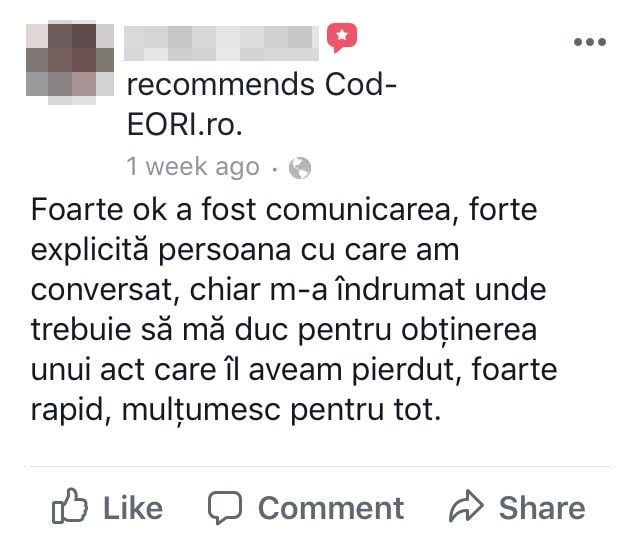

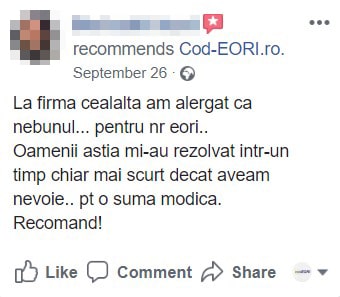

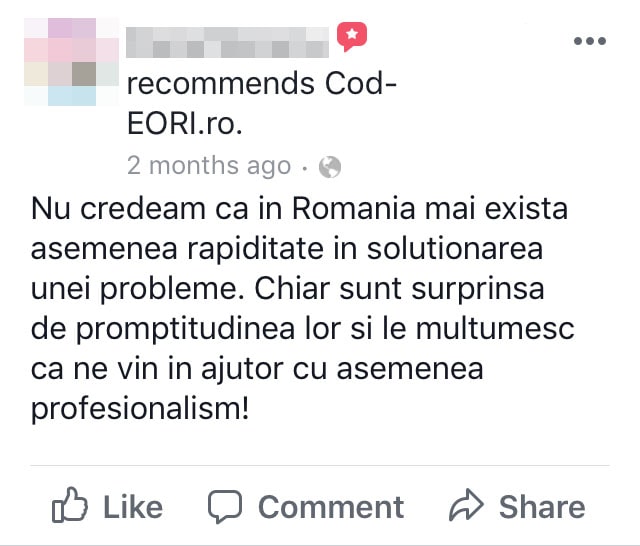

Over 150 real customers recommend us

(click on reviews)